Mastering Advanced Forex Trading Techniques

In the world of forex trading, taking a step beyond the basics can significantly enhance your ability to make informed and profitable trades. Understanding advanced forex trading techniques is crucial for those looking to gain an edge in the highly competitive foreign exchange market. By incorporating advanced strategies and tools into your trading, you can better manage risk, identify opportunities, and optimize your trading performance. advanced forex trading Trading FX Broker can provide valuable resources to help traders navigate these advanced concepts.

Understanding Market Structure

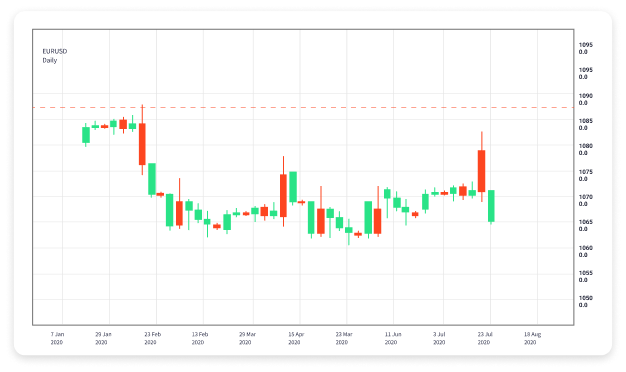

A fundamental concept in advanced forex trading is the understanding of market structure. Observing how the price moves over time can help traders identify trends, reversals, and potential entry and exit points. Key components of market structure include:

- Trend Analysis: Recognizing whether the market is in an uptrend, downtrend, or ranging phase allows traders to align their strategies with the prevailing market sentiment.

- Support and Resistance Levels: Identifying these levels helps traders anticipate potential price reversals or breakouts. Advanced traders often use Fibonacci retracements and pivot points to refine these levels.

- Chart Patterns: Mastering patterns such as head and shoulders, double tops and bottoms, and triangles can provide insights into potential future price movements.

Utilizing Advanced Technical Indicators

While the basic moving averages and oscillators are commonly used, advanced forex trading often incorporates more complex technical indicators that can enhance decision-making. Some of these indicators include:

- Ichimoku Cloud: This multi-faceted indicator provides insight into support and resistance, trend direction, and momentum, enabling traders to make more informed decisions based on comprehensive market data.

- Volume Profile: Analyzing volume at specific price levels helps traders understand where market participants are entering and exiting trades, allowing for better prediction of future price actions.

- ADX (Average Directional Index): This tool measures the strength of a trend, helping traders to filter trades and avoid entering during weak market conditions.

Risk Management Strategies

Advanced trading is not just about finding the right entry point; it’s also about managing risk effectively. Successful traders know that protecting capital is paramount. Here are some advanced risk management strategies:

- Position Sizing: Determining the optimal position size based on account size, trade risk, and stop loss levels ensures that no single trade can dramatically affect the overall account balance.

- Stop Loss Placement: Instead of using a fixed position for stop losses, advanced traders will often adjust their stops based on market volatility and recent price action.

- Risk-to-Reward Ratios: Aiming for at least a 1:2 or 1:3 risk-to-reward ratio can ensure that even if a trader loses on some trades, the gains on winning trades cover those losses.

Using Fundamental Analysis

While technical analysis is essential, advanced traders also incorporate fundamental analysis into their strategies. Understanding economic indicators, geopolitical events, and market sentiment can provide a broader perspective on potential currency movements. Key aspects to consider include:

- Economic Indicators: Monitoring economic releases like GDP, unemployment rates, and inflation can help anticipate central bank policies and currency value changes.

- Central Bank Policies: Decisions made by central banks regarding interest rates and monetary policy can have immediate and lasting impacts on currency prices.

- Market Sentiment: By gauging the overall sentiment of market participants through tools such as the Commitment of Traders (COT) report, traders can better understand potential market direction.

Developing a Trading Plan

An advanced forex trading strategy is incomplete without a solid trading plan. A well-structured plan serves as a roadmap, guiding traders through various market conditions. Key components of an advanced trading plan include:

- Trading Goals: Setting specific, measurable, and realistic goals can keep traders focused and motivated.

- Strategy Definition: Clearly defining your trading strategies, including entry and exit criteria, can minimize emotional decision-making during trades.

- Performance Review: Regularly reviewing and analyzing trade outcomes can help identify strengths and weaknesses in your strategy, allowing for continuous improvement.

Embracing Psychological Discipline

Trading psychology plays a crucial role in the success of advanced traders. Emotions can lead to irrational decisions, which can jeopardize trading performance. Therefore, maintaining discipline is vital. Strategies to enhance psychological discipline include:

- Trade Journaling: Keeping a detailed journal of trades can help traders reflect on their decision-making processes and emotional triggers.

- Mindfulness and Stress Management: Techniques such as meditation and deep-breathing exercises can help traders maintain a calm focus in high-pressure situations.

- Adherence to the Trading Plan: Sticking to the established trading plan, regardless of market conditions or emotional responses, can dramatically improve long-term success.

Conclusion

Advanced forex trading is a multifaceted approach that requires a blend of technical knowledge, risk management skills, and an understanding of market fundamentals. By integrating advanced strategies and focusing on psychological discipline, traders can significantly enhance their trading performance. Continuous learning and adaptation to market changes are essential for long-term success in the dynamic forex market. As you navigate your trading journey, consider leveraging tools and resources from platforms like Trading FX Broker to maximize your trading potential.